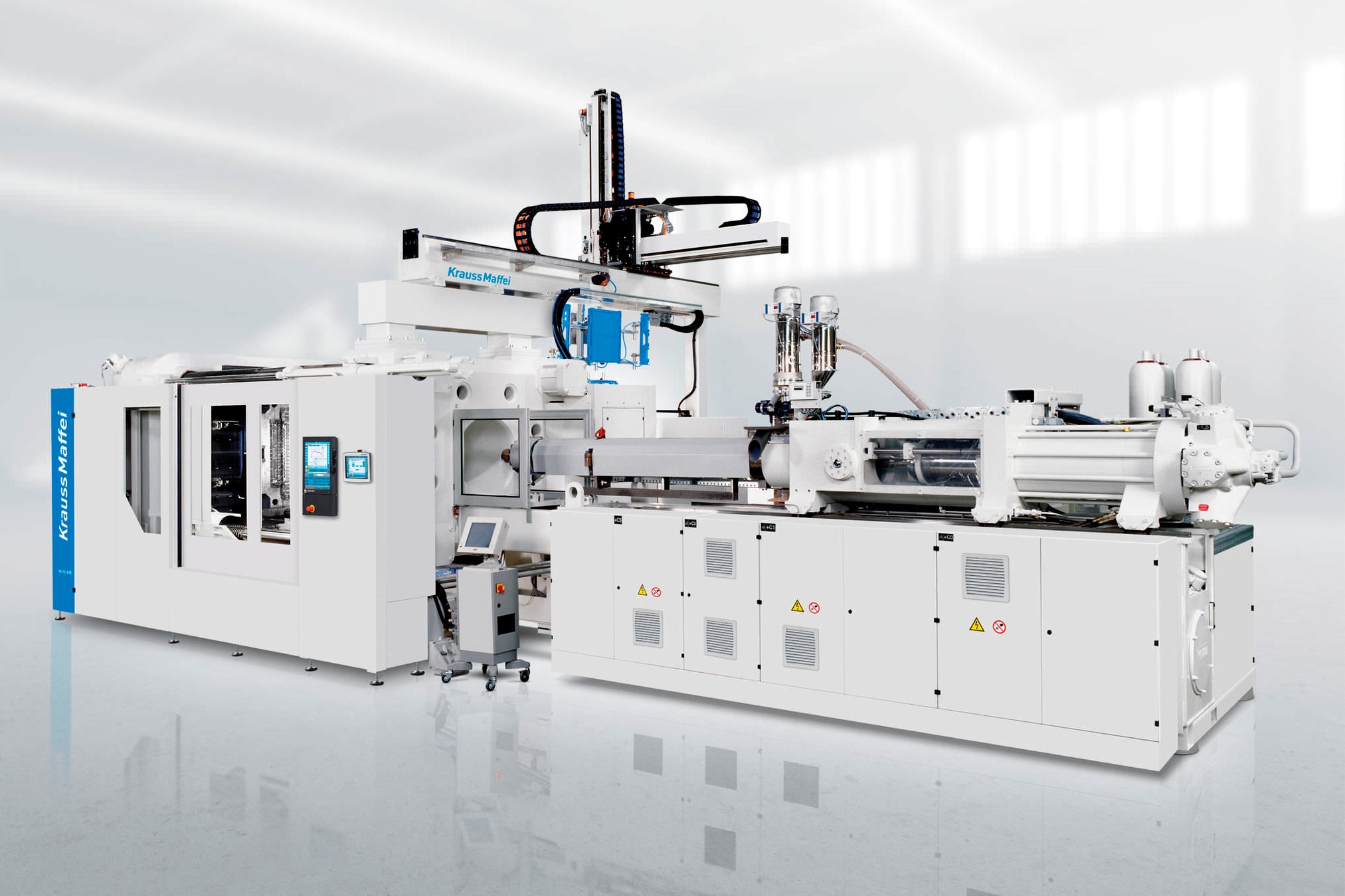

Hong Kong; 25 June 2018. AGIC Capital (“AGIC” or “the firm”), the leading European-Asian private equity firm focused on investments in high-growth sectors, today announces the sale of its stake in KraussMaffei Group (“the Company”), a leading global manufacturer of high-quality machinery and systems for producing and processing plastics and rubber, to China National Chemical Corporation (“ChemChina”).

AGIC participated in the EUR 925 million acquisition of KraussMaffei Group in January 2016, as part of an international investment consortium with China’s largest chemicals group ChemChina and GUOXIN International Investment Corporation (“Guoxin”). The joint acquisition marked the firm’s first investment from AGIC Fund I and, at that time, represented the largest outbound investment from China into Germany.

During the investment period, AGIC has worked closely with the consortium and KraussMaffei Group’s management to support the Company’s continued expansion in Asian markets. During the period of AGIC’s ownership, sales into China have grown significantly.

Commenting, Henry Cai, Founder and Chairman of AGIC said: “After a successful period of ownership, we are delighted to be selling our stake in the company to one of our co-investors. It is the right time for AGIC, and in the lifecycle KraussMaffei Group, for us to divest our stake and complete our first exit from the Fund I.”

Frank Stieler, CEO of KraussMaffei Group said, “We would like to thank AGIC for the support and guidance as we have continued to expand our footprint into Asia. As we continue to pursue our strategy for growth in Asian markets, we look forward to continuing our long-term partnership with ChemChina.”