ABOUT US

AGIC Capital is a growth-oriented European-Asian private equity firm

AGIC Capital is a firm with US$2.2 billion in Assets under Management focused on investments in the advanced industrial technology and healthcare technology space in Europe & beyond. We invest in great companies and management teams with differentiated and innovative services and technologies that have market leadership potential and the ambition to substantially scale internationally, in particular in the Asian markets.

Investment Strategy

We seek to invest between €50 and 250 million per deal in majority and minority transactions. We have an investment horizon of up to 10 years in which we will work with the portfolio companies to develop and implement plans that support long-term growth.

Leveraging our sector know-how, international networks and knowledge of local markets, our global team provides hands-on management and operational support to our portfolio companies to help them realize their full growth potential.

Deals

AGIC Capital is an active partner to all portfolio companies. We work hand in hand with the management teams on specific value creation plans that promote sustainable business growth – either through expansion to new markets, add-on M&A, or investments in the core business, e.g. digitization or new products/technology.

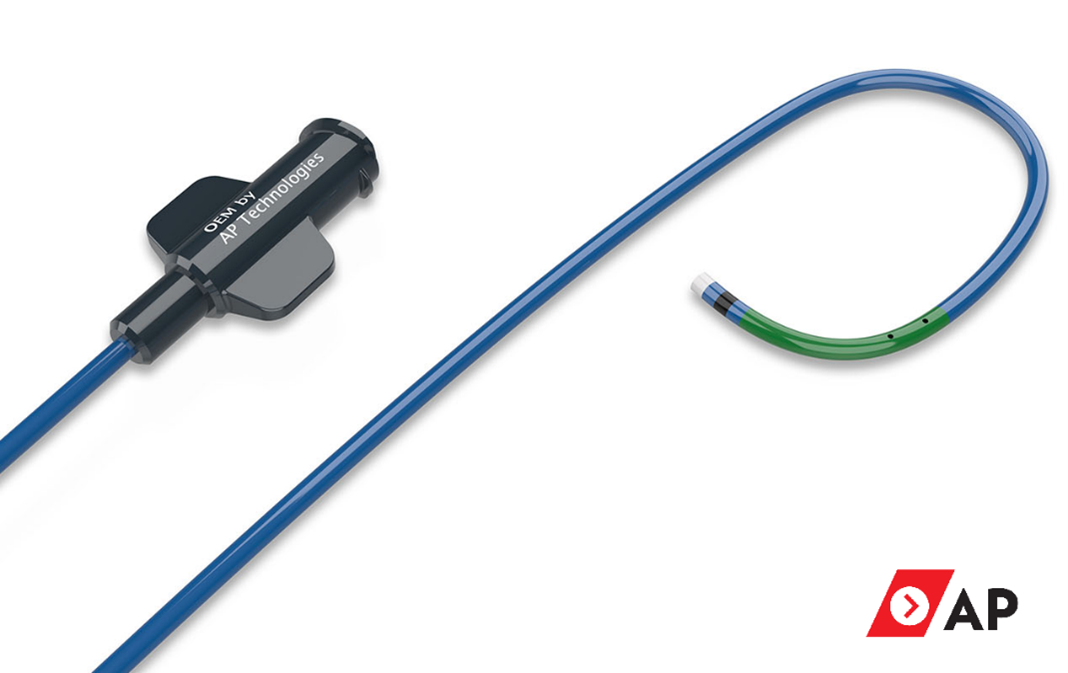

AP Technologies

Premier emerging medical device contract manufacturer specializing in precision medical tubing and catheter assemblies. AGIC completed a growth equity investment into AP technologies (“AP Tech”) in August 2023.

Pure Trade

A leading supply chain solution provider in the premium packaging space. AGIC acquired a majority stake in Pure Trade in July 2023 with re-investment from key management team.

PR Electronics

A leading supplier of signal conditioning devices. AGIC acquired PR Electronics in June 2023 alongside Kirk Kapital and management.

Atec Pharmatechnik

A leading manufacturer of aseptic processing solutions for sterile pharma systems. AGIC acquired a majority stake in Atec Pharmatechnik in December 2022 with re-investment from existing shareholders in a minority position.

Farsound

A leading provider of technology enabled supply chain solutions for the aerospace engine MRO market. AGIC acquired a majority stake of Farsound in 2019 alongside management.

Fotona

A manufacturer of innovative medical laser systems for aesthetic, dental and gynecological applications. AGIC acquired a majority stake in Fotona in April 2017 alongside management.

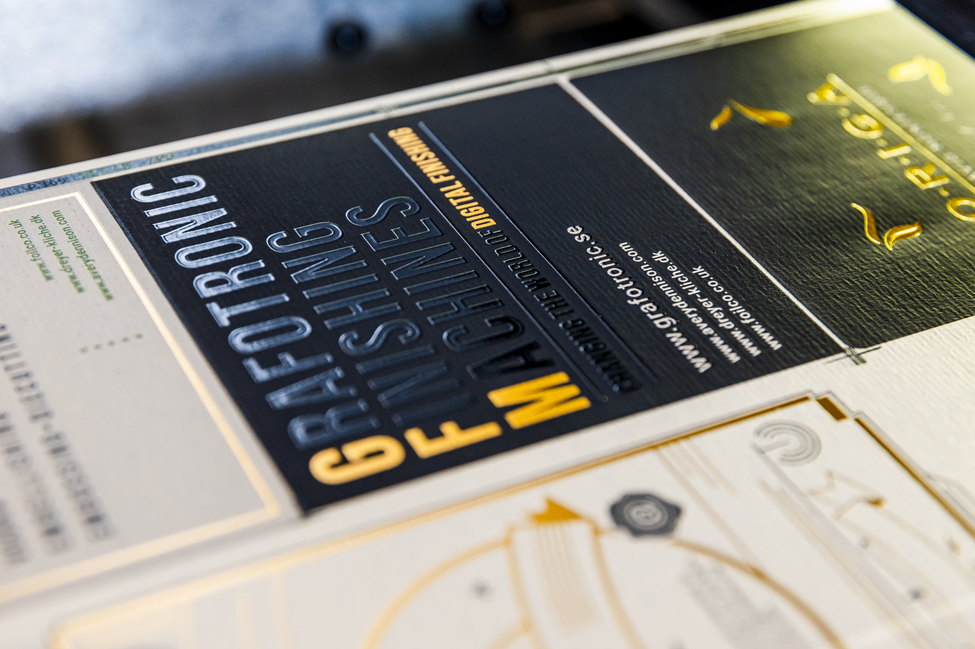

Grafotronic

A leading supplier of modular roll-to-roll automated manufacturing solutions.

Eulitha

A leading non-contact Nano-UV-Lithography equipment provider for photonics applications.

Team

The team in Europe and Asia includes seasoned investment and portfolio management professionals with complementary expertise and skills from an industrial and healthcare backgrounds. The team is supported by a number of senior advisors and industry experts with vast industry expertise and a deep network which is also available to our portfolio companies.